Categories for News

What to expect from Vancouver real estate in the coming months

June 1, 2017 10:38 amBritish Columbia’s foreign-homebuyer tax for Metro Vancouver was no panacea for massive price gains in the red-hot housing market, experts suggest. “If it was damaging to begin with we would see significant drops in the prices of these homes,” Aaron Chen, president of local brokerage AISA Real Estate Services, tells BuzzBuzzNews. “What it really did was to cause a lot of investors or homebuyers to step on the sideline, to see if the prices come down or not,” he adds. Last year in July, Greater Vancouver home prices saw a 30-plus per cent year-over-year increase compared to 2015. But when the tax was introduced in early August 2016, monthly price gains began waning, suggesting the tax was having a cooling effect on the market, at the time Canada’s hottest. In fact, according to BMO Economics prices declined 4 per cent... View Article

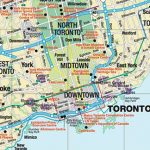

Ontario Municipal Board: Rest in Peace

May 17, 2017 8:21 amThe Ontario government has announced a major proposed change to the way development disputes between builders, municipalities and communities are settled throughout the province. The provincial government says it is tabling new legislation to replace the Ontario Municipal Board with what is being billed as the Local Planning Appeal Tribunal. “If our reforms pass there would be fewer and shorter hearings, and a more efficient decision-making process — there would be more deference for more local-land-use planning decisions,” said Bill Mauro, Ontario’s municipal affairs minister, The Globe and Mail reports. The OMB currently makes decisions on appeals concerning planning issues including zoning bylaws and official city plans. Critics of the quasi-judicial tribunal suggest it too frequently sides with developers, overturning decisions made by local planning departments and neglecting the interests of the communities they serve. Toronto Councillor Josh Matlow is... View Article

April Market: 11 Points to Consider

May 5, 2017 8:17 amApril was an interesting time to be a housing market observer in the GTA. Just as many had speculated, provincial government introduced a bevy of new measures aimed at stabilizing segments of the Ontario residential real estate market that it believes are overheating. In total, 16 measures were introduced by the Wynne government under its Fair Housing Plan. Panned by some and lauded by others, it’s unclear if the plan will have the desired impact, especially with some questioning the efficacy of the critical Greater Golden Horseshoe foreign-buyer tax component. Today the Toronto Real Estate Board (TREB) released its April 2017 report on the GTA market. Anyone expecting the data to reveal any seismic shifts in the market spurred by the Fair Housing Plan will be disappointed. Staggering price increases are still the big story here. Then again, it’s only... View Article

Will an interest rate hike put a freeze on Toronto housing prices?

April 11, 2017 7:32 pmTwo top economists recently came to the same conclusion about what it would take to cool off Toronto’s blazing housing market. It wasn’t imposing a foreign-buyer tax, as some observers have called for. Nor was it a Vancouver-style vacant-home tax, the likes of which Toronto Mayor John Tory is reportedly mulling, or increasing supply. No, both National Bank Chief Economist Stefane Marion and BMO Senior Economist Robert Kavcic suggest higher interest rates can take the steam out of Toronto home prices, which have rapidly appreciated to the point where a detached home in the city cost $1,561,780 on average in March, according to the Toronto Real Estate Board (TREB). “It was [Bank of Canada] rates hikes that ultimately broke the late-80s run, and (fully understanding rate hikes are not local) a 4% 5-year fixed rate would quickly do to Toronto... View Article

Who’s eating you out of house and home?

March 23, 2017 3:24 pmTermites are not the type of guest you want in your home. Termites are extremely destructive little guys and they always travel with about a million of their relatives. These ferocious eaters cover all of Toronto except for a few areas. These insect aliens are looking for a meal to bring back to their colony, that’s right, they take a few bites out of a wood joist or wood stud and they travel back to their colony far underground. There they distribute your yummy house to their friends and family. One colony of termites can take on 3 or 4 houses at a time. If your neighbour is treating their property for termites, you should also. If you don’t currently have termites it won’t take long before you do. There are termite companies that use an environmentally friendly treatment and... View Article

What are the benefits of working with a realtor to find a rental?

March 10, 2017 5:52 pmNavigating the rental market can be a daunting task. The Canadian Mortgage and Housing Corp. recently reported a 3.4-per-cent vacancy rate for rental properties across the country. Meanwhile, in Toronto, prices increased 11.7 per cent in 2016, according to data collected by Urbanation. Clearly, rental properties are in high demand. And rentals are now receiving multiple offers, often going to the tenant who bids highest and for above the asking price. So there can be advantages to using a real-estate professional to find a rental. But not all brokers and salespeople handle rentals. As well, the representative would typically show you rentals that are listed on Realtor.ca; landlords are less likely to pay a commission if your agent approaches them through a listing on Kijiji or Craigslist — so you need to discuss and decide on how the real-estate rep... View Article

The Bank of Mom and Dad: The ways Toronto parents help their kids buy homes.

February 28, 2017 9:11 amA Toronto-based mortgage agent has seen more parents taking equity out of their own homes lately to help their children achieve their otherwise elusive dreams of homeownership. “I think it’s increasing because, frankly, the price of real estate is just becoming virtually impossible for first-time buyers to tap into the market,” says Elan Weintraub, a director and mortgage agent with the brokerage Mortgage Outlet. Last month, detached homes in the Greater Toronto Area sold for an average of $1,068,670 and condos went for $442,598, according to the Toronto Real Estate Board. Those are year-over-year increases of 26.3 per cent and 14.5 per cent, respectively. Weintraub gives a hypothetical example that illustrates the way he’s seen some parents give their kids a leg up in an exhorbitantly expensive market. He describes a 50-year-old with $100,000 left to pay off towards their mortgage... View Article

Stay Grounded! Know What You Can Afford

February 14, 2017 11:24 amWhen you are involved in buying a property and there are multiple offers, it’s best to keep your feet planted on the ground because the bank may say “no deal”! This does happen, especially now in the US, where banks were badly burned in the bubble of 2006–2007. Back in those crazy days, wildly inflated home appraisal values were routinely submitted to the banks, so that virtually any breathing applicant would qualify for a mortgage. The consequences were disastrous. But even in normal, stable markets like Canada’s, a large asking-selling discrepancy could spell trouble for the purchaser. Since institutional lenders (banks) lend a percentage of the appraised value of the home, a low appraisal can make it hard or impossible for the purchaser to put together the financing. Assume you buy a home for $400,000 and put 20 per cent ($80,000) down. You need... View Article

CMHC Mortgage Loan Insurance

January 30, 2017 9:11 amWhat is CMHC Mortgage Loan Insurance? Mortgage loan insurance is typically required by lenders when homebuyers make a down payment of less than 20% of the purchase price. Mortgage loan insurance helps protect lenders against mortgage default, and enables consumers to purchase homes with a minimum down payment starting at 5%* — with interest rates comparable to those with a 20% down payment. To obtain mortgage loan insurance, lenders pay an insurance premium. Typically, your lender will pass this cost on to you. The premium payable is based on a percentage of the home’s purchase price that is financed by a mortgage. The premium can be paid in a single lump sum or it can be added to your mortgage and included in your monthly payments. Mortgage loan insurance is not to be confused with mortgage life insurance which guarantees... View Article